How Connected TV Advertising Works

With programmatic inventories shrinking, and costs rising, understanding how connected TV advertising works will help you maximize your return on...

14 min read

Ben Chansky

:

Apr 20, 2021 3:31:43 AM

Ben Chansky

:

Apr 20, 2021 3:31:43 AM

In just two decades, there have been drastic changes to how consumers access entertainment. It wasn’t that long ago when pay television was the new thing and we regularly drove to the video store to pick out a few movies to watch on the weekend.

Today, the video stores are long gone and, for many, so are the original iterations of pay television (cable/satellite). More and more consumers are cord-cutting and turning to streaming content instead. The library of content we have can immediately tap into far exceeds even the largest video store library back in the day and provides access to and discovery of older titles, along with frequent new additions. In addition, consumers can watch this content in so many more ways than ever before, including via their smartphones and streaming TV devices such as Amazon fire stick.

Televisions aren’t going anywhere, but the whole experience has changed—for consumers and advertisers.

This guide will walk you through the implications of this change in television consumption for viewers and digital advertisers, and demonstrate why contextual connected TV (CTV) advertising is the next big frontier for advertisers.

The year 2020 was an unprecedented one in many ways, especially when it comes to how we watch television. In fact, we’ve seen accelerated growth in the shift of consumer viewing habits as people all over the globe settled into a new reality.

The ever-increasing speed and access to internet connectivity, along with the exponential improvements of technologies such as multi-use, internet-enabled TV devices such as gaming consoles, dedicated streaming devices, and the arrival and affordability of smart TVs (aka connected televisions) such as Apple TV and Roku have caused an evolution in consumers expectations of content and how they interact with it.

Netflix disrupted video rentals and the TV industry soon followed, forever changing how consumers watch TV. They created compelling original programming and redefined how programming was released. Viewers suddenly had access to an entire season at once vs. cable’s once-a-week model.

Beyond that, the subscription model gives Netflix a powerful advantage: a steady stream of user data they can analyze to make programming decisions based on what people are watching. Essentially, Netflix uses context and category to understand the consumption habits of their users—all while giving them freedom to consume content on their own terms. No longer is television viewing confined to living rooms and bedrooms. Users have freedom to watch from their mobile phones on their daily commute, or spend an entire day binge-watching their current favorite episodic TV series via a streaming video service.

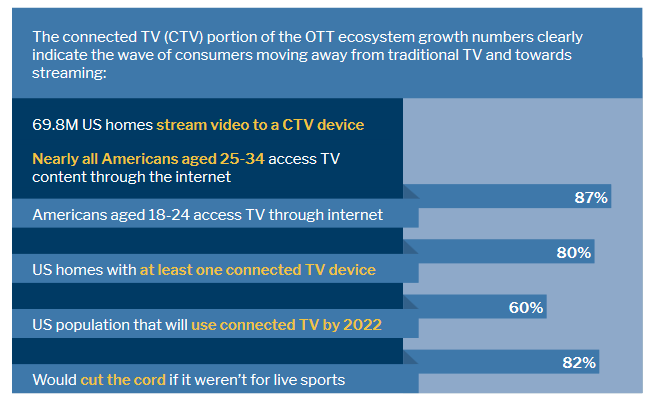

Connected television (CTV) was once seen merely as a cable alternative and the catalyst for cord-cutters (when consumers drop pay television services like cable/satellite) and cord-shavers (when consumers reduce cable services). But CTV is now mainstream—over one-third of American households have shifted to stream video and TV content as their exclusive source of television entertainment.

Viewing time for streaming content in the past year is up 57% globally, though Europe had the highest increase (121%), followed by South America (104%) and North America (51%). However, when you look at content and device type specifically, CTV is up over 200%.

There’s little doubt that streaming’s explosive growth will have a huge impact on the $177 billion dollar global television advertising market. CTV is big, and it’s growing fast.

"CTV is now mainstream—over one-third of American households have shifted to streaming as their exclusive source of television entertainment."

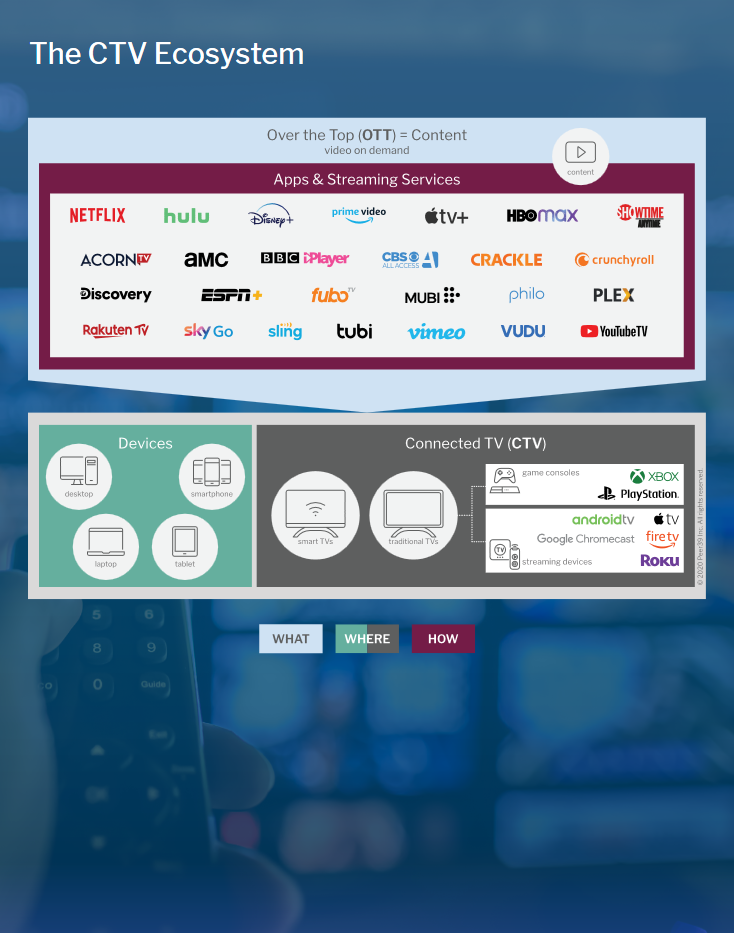

CTV and OTT are often use interchangeably, but they are not the same thing.

All content on connected TV (CTV) is considered an over-the-top media service (OTT), but OTT content can also be viewed on non-CTV devices such as laptops or mobile phones.

Like any emerging technologies, CTV brings with it a host of new acronyms and questions about how it all fits together: It helps to think about it as the “what," the “where," and the "how" of CTV.

This quote from the IAB sums up the "what" of CTV nicely:

The term “over-the-top” originated in the broadcast world. Content that was originally distributed for view on TVs using broadcast, cable, or satellite channels began to be served online, or “over-the-top”. It was used to refer to content being distributed via the internet, and viewed on desktop computers and mobile devices (which were the primary means to consume OTT video at that time). However, when people lacking experience in broadcast, and only accustomed to streaming to mobile and desktop, began to use the term OTT, they applied the term to devices other than mobile/desktop – causing a lot of the current confusion.

The second key distinction between CTV and OTT is where content is consumed.

As the technology evolved, over-the-top content began to be served online and viewed on computers and mobile phones, the primary means for consuming online content in the early days of TV and video streaming. This idea of watching “television” on a device that isn’t a television was quite the novelty. Consumers like the television experience, though. And connected television (CTV) enhances that experience in a variety of ways. CTV refers specifically to internet-connected devices that connect to TV screens for viewing.

There are three types of connected TV devices:

OTT content is delivered to internet-connected TV devices through a variety of channels or video streaming services and apps. While some services are hybrids that support mixed models, here’s the general breakdown:

The help visualize these three points, here’s a detailed illustration of the CTV ecosystem as it exists today:

Now that we’ve defined what CTV is, where the content lives, and how people consume it, let’s look at the benefits of how connected tv advertising works for advertisers.

For advertisers, OTT content is an increasingly attractive option for TV campaigns thanks to the speed of growth in consumer adoption. After all, you want to ensure your ads show in the places your audience is spending their time and attention.

CTV is an accessible channel for all digital advertising. It’s not just for those with significant budgets to invest in up-fronts to reach audiences previously not part of their mix. And CTV gives advertisers the ability to test and learn with different formats for TV ads as well as discover new content, all at a fraction of the cost of linear TV. And because it’s digital, advertisers benefit from the targeting that they have come to expect in the digital media environment, like geo-targeting and audience targeting.

With the shifting consumer behavior, not all households have cut the cord on traditional TV, but cords are definitely fraying:

Even with the variety of choices available to access OTT content, connected TV is still the chosen method of viewing more than 50% of the time worldwide. Through apps and TV and video streaming services, CTV offers consumers a more personalized or curated experience, a wider choice, and discovery of new content, through a variety of models. These range from a selection of free content with a set programming schedule or on demand, to free linear (live) TV, and those that curate and suggest content based on what you’ve watched, like, or don’t like (e.g., if there was a Pandora for CTV.)

Consumers are clearly enjoying the convenience of the CTV experience thanks to improved internet access, faster internet speeds, reduced costs, and the ease of using connected TV devices. With so many consumers shifting to more flexible models for consuming television, it’s no wonder advertisers are fast to follow them.

Download this free eBook from Peer39 today to learn more about the big picture of CTV, and why it’s the next big frontier for advertisers.

Though consumers are quickly adopting CTV, ad targeting in the CTV environment isn’t yet straightforward for advertisers. There are complex challenges across “what” (content), “how” (apps and streaming service providers), and “where” (device)—and it comes down to transparency, fragmentation, and budget.

There’s no simple, single way to make ad buys for CTV. You can buy from the content owner (video publisher), TV network, distributor, streaming service provider, device manufacturer, specialized programmatic platforms, aggregators (like Pluto or Sling), aggregators of aggregators (like Roku and Amazon) and marketplaces. Each has its own pricing model and delivery specifications, which makes CTV buys time-consuming, complex, and inefficient.

Fragmentation is not solely restricted to the content side, it applies to the consumers’ viewership as well. The average American subscriber watches 3.4 services which means, unlike linear TV, the audience attention you seek is distributed across multiple services, platforms, and apps with no unified point of access or insight.

Budget also poses challenges for advertisers. Where the necessary budget for CTV will come from—digital ad, video, or linear TV budget—advertisers will need to unify their thinking across specialized teams around how their paid media is placed. All this complexity isn’t getting better, which leads some to believe the ideal ad buyer’s world is merely a dream.

Three of the largest CTV platforms, Amazon, Samsung, and Roku, operate their own DSPs. Each of them has privileged access to their respective company’s user data and exclusive access to some inventory. In some cases, these DSPs are buying ads beyond their platform inventory by “plugging into different programmatic marketplaces and setting up deals with publishers.”

A complex playing field for CTV advertisers

All of this makes for an uneven playing field, and the complexity for advertisers in CTV/OTT advertising is not necessarily limited to certain platforms like Amazon Fire stick, Samsung, or Roku. As a result, each advertiser will take a different route, and the majority of advertisers will need to employ a multi-DSP approach to build out their CTV strategies, requiring two or more platforms.

Fragmentation is also found behind the scenes in how communication takes place between various ecosystem participants looking to transact on OTT-CTV and the problems that affect programmatic buying platforms and publishers with CTV inventory are directly connected to the challenges advertisers face.

If you’ve ever looked at a post-campaign report of where you ran on a CTV buy, then you know this problem and the complexity first hand. The CTV ad campaign report is filled with IDs that often look meaningless, yet there are many of them. Surprisingly, this is also an issue for the CTV/OTT advertising platforms, and selling platforms as well.

The IDs are meant to provide an understanding of the ad opportunity but with no standardization, and with the overwhelming number of ways that an ad opportunity can be sold to an advertiser, this has led to further fragmentation in the buying process.

As a result, buying platforms are unable to surface meaningful data to advertisers for reaching their target audience with any level of confidence. This limits the targeting available to advertisers. Currently, targeting OTT and CTV in the buying channel is limited to technical attributes, such as device, operating system, connection speed, and audience—to the extent those have been matched up. There is very little data available around the content a consumer is watching at the moment.

Further complicating the CTV ad buying process is the wide range of strategies for how OTT service providers, apps, and device manufacturers package their inventory. Some tie their inventory and/or proprietary first-party data to direct deals or private marketplaces (PMPs). This makes it challenging to use tactics, performance optimization, and creative decisions that modern digital marketers have come to expect and depend on.

It’s early days for CTV. The complexities around the buying process the fact that it’s significantly more expensive than digital video CPMs, even though pricing is on par with linear TV (CPMs between $20-$40), and targeting limitations and inconsistencies in inventory availability need to be ironed out. Therefore, many advertisers are buying viaprogrammatic direct/guaranteed or through PMPs.

That said, direct deals and individual PMPs can be inefficient, requiring additional work by the advertiser to create and manage many at one time. CTV-curated deals in the DSPs allow you to select from assembled inventory but are limited in their targeting abilities, and advertisers aren’t always able to leverage modern digital advertising techniques.

Buying for CTV right now is similar to a cross between the digital ad networks and TV buying. As the market grows to reach nearly $11 billion by 2021, nearly 60% of ads will be bought programmatically.

Ad spend for CTV is projected to grow to $14.12 billion by 2023. In the past two years, CTV supply more than tripled. In 2019, OTT-CTV ad transactions had global growth of 330%, along with a 232% increase in OTT-CTV apps that support programmatic ad campaigns. CTV ad impressions account for half of all video ad impressions, which is nearly double that of mobile.

The pandemic hasn’t hampered growth in CTV spend. In its recent study, “IAB U.S. 2020 Digital Video Advertising Spend Report: Putting COVID in Context,” IAB research revealed that buyers are reallocating ad spend on CTV from broadcast (53%) and cable TV (52%) advertising towards CTV. The average spend per advertiser is expected to hit $16 million in 2020, with many shifting dollars from their traditional linear budgets for TV ads.

The same study from IAB listed the largest connected TV buying segments and their average per advertiser spend: retail ($32.2 million), media/entertainment ($31.9 million), and telecom ($20.6 million).

Connected TV has proved to be resilient during the global pandemic, taking share from traditional TV budgets,” said David Cohen, President, IAB. “Buyers are not only following consumer attention, they are flocking to CTV because it is the perfect marriage of high-quality content, superior targeting, in-market optimization, and robust measurement. We are also seeing a strong desire from buyers to look at the video marketplace holistically, and the continued convergence of omni-channel video planning and buying solutions.

The consumer experience is similar to linear TV with premium, long-form content, watched on the big-screen in their living room. However, connected TV ads are delivered through an internet connection, making the ad experience for viewers big-screen, and it differs from linear TV ads. It’s not skippable and has an unprecedented video completion rate of 97%. For homes with a smart TV, family or friends will often watch together, where TV ads are seen by more than one person, unlike when OTT is consumed on a personal device like a mobile phone.

The transition from traditional TV campaigns to connected TV ads is a blend of what consumers already know: traditional TV ads seen while surfing, both before and during content (pre, post-roll), is pretty seamless. Many consumers feel watching the TV ads is a fair value exchange for content at a lower cost and, unlike ad campaigns in linear TV, don’t find them as annoying.

Additionally, research from Telaria shows that viewers find connected TV ads more relevant, and that translates into them being twice as likely to buy after seeing CTV/OTT advertising compared to the same linear TV campaigns.

Advertisers can reach communities and audiences that don’t watch live television and haven’t ever had cable service. Direct-to-consumer brands have the opportunity to increase brand awareness and reach among younger audiences with connected TV ads.

As consumers flock to CTV and other devices to access and stream video content, the case for moving digital advertising dollars to the CTV space has grown. CTV has the ability to bring the aspects of digital advertising to the TV channel. But the landscape is in its early stages, and its complexity creates hurdles for advertisers, so it’s important to know what to expect before you jump in.

There is often an assumption made that if you’re buying connected TV ads that you’re getting premium OTT advertising content. That’s not always the case.

Let’s say you check the CTV box in your DSP: There’s no guarantee you’ll only get OTT content. You might get OTT and mobile apps because both can show up on connected TVs. The same is true for OTT content on mobile phones and laptops/desktops.

Are you willing to pay the same price? Make sure you’re aware and ready for this before you buy.

Before you bid is the time to make meaningful decisions about where your TV ads run. Planning is an essential part of the CTV/OTT advertising buying process. Look at the data critically:

Ask these and other relevant questions in your planning as the answers differ greatly by platform.

The growth of CTV is astounding. Technology led the way and created a shift in user-consumption habits. Publishers and content creators followed, and now advertisers have an opportunity to expand their marketing and engage with consumers in new ways.

As with any form of media, knowing users and what they like is great, but reaching them is amazing. It’s as precise as you can get if the data is accurate. However, if you don’t reach that user in a contextually relevant environment, then as an advertiser you have wasted an opportunity, money, and you may not reach your objectives.

Context can be the device a viewer is using—personal phone, tablet, computer, or television—and it’s what they’re watching. Is it light, airy, and binge-worthy, or is it a bit more heavy and will have a profound impact on their mood?

Users, in general, are much more open to seeing and reacting to ads that are relevant to the context in which they are seen. If the content and offering in the TV ad is relevant to what the person is watching, then there is a heightened chance that that person will take interest or, even better, a desired action based on that content.

On the flip side, if ads are not relevant to the context in which they’re seen at all, users may find them annoying, intrusive, and irrelevant, thus harming that individual’s association with the brand and product offering.

Needless to say, this alignment between context and digital advertising can pay great dividends for advertisers looking to improve the long-term impact of their TV ad content, and the loyalty it can generate from users.

Context is everything, everywhere. And it matters in CTV.

OTT-CTV can pose risks to marketers when it comes to brand safety & suitability, leaving advertisers asking questions such as:

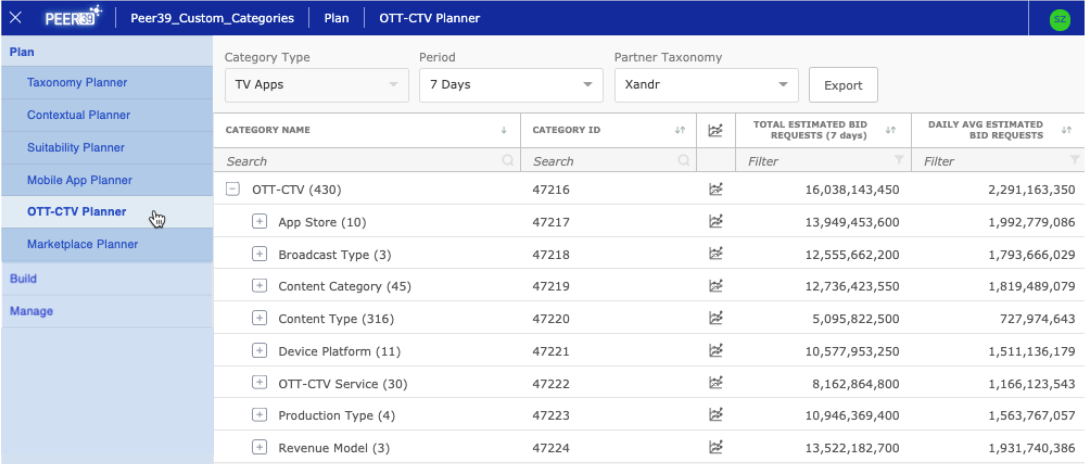

Peer39 CTV Suitability categories enable you to run in content that we know is safe–and steer clear of the kinds you want to avoid. Confidently target by content type–such as Arts & Culture, Automotive, Cartoon, or Documentary—or on a verified valid channel such as ABC, BBC, CNN, and other networks.

The Peer39 suite of contextual solutions provides a broad range of self-learning semantic targeting options with a feature-rich contextual planning and a custom category creation platform for everyone on your team to work within.

More importantly, these tools give you and other ad buyers contextual signals that you need to be able to target users based on what they are watching in that moment in time.

This is accomplished by giving advertisers more granular control and visibility into data to inform their strategy, all the way from the demographics of their target audience to metrics such as video completion rate to inform prospecting and retargeting campaigns.

CTV advertisers can identify how many OTT requests are available overall, across various OTT services or connected TV devices, a particular network, and, perhaps most importantly, view inventory by contextual content category, and avoid unsuitable content.

Additionally, these tools give you a deeper understanding of the programming of CTV ad impressions, and offer deeper insights for planning, targeting, and activating ad campaign.

The combination of Peer39 classification technologies (semantic, mobile, etc.) creates an opportunity for advertisers to find target audiences in programmatic CTV-OTT, beyond traditional TV channels and content.

With Peer39, you’ll get consistent, uniform, and scalable contextual ctv data for planning and targeting your CTV campaigns. Fill out the form below and someone from our team will reach out to help you optimize your campaigns for CTV!

.webp)

With programmatic inventories shrinking, and costs rising, understanding how connected TV advertising works will help you maximize your return on...

1 min read

Contextual CTV offering adds new levels of accuracy, scale, and transparency, aligning expectations with modern digital marketing. New...

Programmatic advertising is a widely-used and fast-growing segment of digital marketing that uses automated tools and real-time bidding to purchase...